Breaking Down the QRA and FOMC Meeting

It's gonna be a big week.

This week, we have had two major Macro events: the QRA and the FOMC meeting. In this article, I break down my analysis on both. Enjoy!

Quarterly Refunding Announcement.

The reason the QRA matters more so than ever is two-fold:

1) The vast majority of positive liquidity dynamics within markets right now is coming from the Fiscal side of the equation, not the Fed/monetary. The US Government is running major fiscal deficits during a time where the economy is expanding. Because of this, how that spending gets funded creates an impact on the duration that comes onto the market to digest.

2) More debt is coming to market at a time where long term marginal buyers of debt are leaving. I.e QE through the Fed or Foreign debt buyers such as Japan and China.

Because of the weight of these two dynamics, the QRA has begun to play a more important role in Macro top-down analysis.

In general terms, higher issuance of longer term debt increases yields, increases duration, and increases term premium (the expected payment investors require to take on longer term debt over short term)

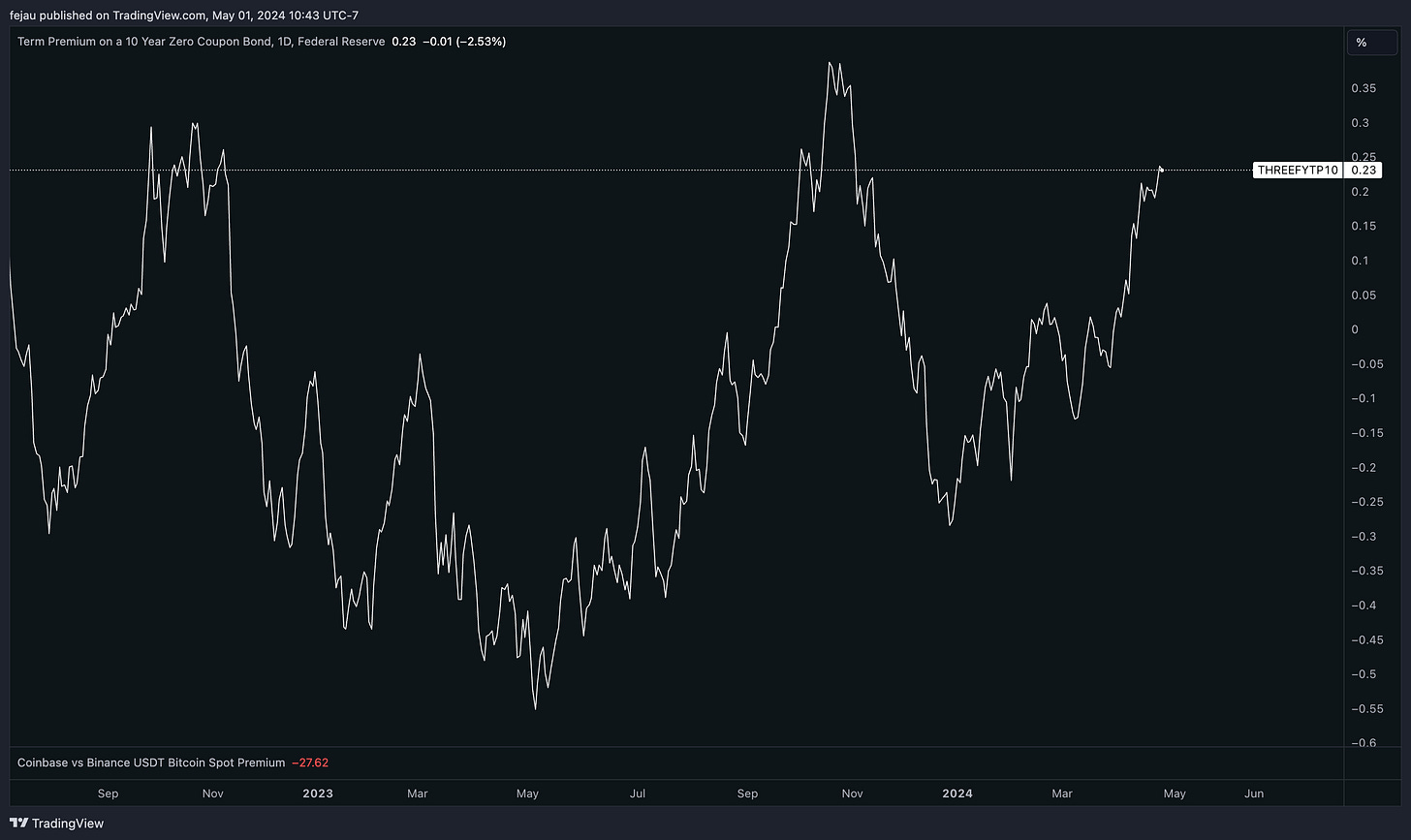

As we see below, term premium has been heading higher in recent months as we have been experiencing a Bear Steepener in the Yield Curve where long term rates have been rising faster than short term rates.

With this in mind, we headed into this week’s QRA with a few things in mind:

Last quarter, Yellen and the Treasury guided that there would be no marginal increase in long end debt being issued than what has already been forecasted. With recently rising yields, many were wondering whether this would still hold true

With the RRP (the primary funding mechanism of recent Tbill issuance which has been increasingly becoming a bigger piece of the issuance pie) substantially lower than previous quarter, the question of how much total $ value would be issued and how many Tbills would need to be digested by non-RRP flows.

Many have been theorizing on Yellen using the TGA account as a liquidity injector by running the TGA account below its $750b minimum. I personally viewed this as ridiculous, but many were theorizing on the idea.

Let’s now break down what we actually learned from the release:

$ Value Issuance:

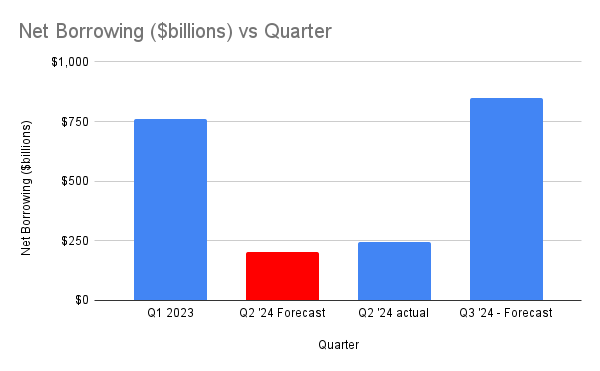

The $ value of actual issuance for Q2 came in higher than forecasted last quarter at $243b net borrowing, vs the expected $202b. This was due to lower than expected cash receipts/revenues. As well, Q3 forecasted issuance is going to be $847b which is above trend and significant.

The TGA account is forecasted to be at $850b vs the recent trend of $750b. This makes for $100b coming off the market in terms of $ liquidity. As well, this goes completely against the speculators who thought we would see a major draw in TGA in the lead up to the US election.

Overall, the total $ value being issued + higher TGA account we can tick as being net hawkish/bearish/more issuance than market expectations.

Composition of Issuance:

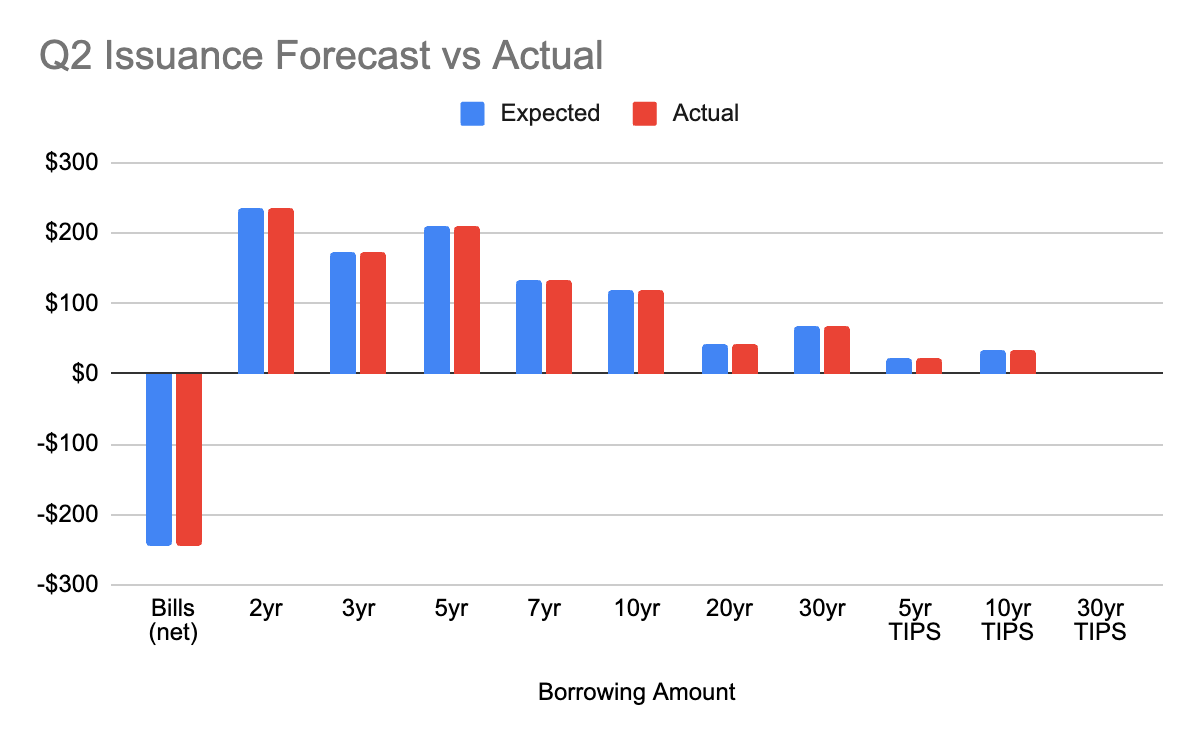

The composition of the issuance is a much more boring story. Much like TBAC said last quarter, the % amount of long end issuance remained the same with no change, and that stayed the same for the forecasted Q3 quarter as well. Therefore, there is no net new duration for market expectations to digest.

Overall, my read on the QRA is that it was mostly net-neutral with a hawkish tilt. It certainly was not the dovish/market pumping catalyst many had hoped for. Overall, the market is going to have to digest more Tbill issuance than expected. Although Q2 will see negative net-issuance of Bills since the TGA is substantially above that $750b target at the moment, the issuance will accelerate in Q3 of which RRP balance should digest most of it.

FOMC Meeting

During the FOMC meeting, the Fed announced no change to Federal Funds Rate, in line with expectations.

Notably, they did announce a taper to Quantitative Tightening, and are planning to cut the runoff of Treasury bonds by $35b per month, and are keeping MBS runoff constant. Based on the last month’s FOMC minutes, market expectations were for QT to decrease by $30b. Therefore, there was a dovish surprise on QT taper by $5b/month.

Based on the debt issuance discussed above, this will provide a substantial ease to the level of debt pressure we are seeing.

During the press conference, one of the key things I was looking at is whether Chair Powell would open the door to the possibility of rate hikes coming back on the table.

When directly asked whether this was a possibility, he said it was unlikely that the next move would be a hike.

In terms of Fed governor talk, this is pretty much as certain as we get around this topic.

Considering the market has already priced in little to no cuts for 2024, the lack of hawkish tail risk means that risk assets should see upside from here.

Overall the key FOMC takeaways I see are:

Though expected, QT taper was marginally dovish

Confirmation of inflation being higher than expected recently is taking rate cuts off the table, but the market was already priced for that

With Powell taking hikes off the table, that cuts off tail risk of the range of possible outcomes which leaves the possibilities as either neutral or dovish from here.

Looking at the 2y bond yield, we see that the market is certainly taking today as dovish.