Rot at the core

The implications of the possibility that the risk free rate that underlies all financial assets isn't accurate anymore

Think of the financial system as a set of lego pieces that make up a pyramid. At the foundation of the pyramid lies the risk-free rate, based on the US dollar and the yield associated with it. This foundation is represented by what is considered pristine collateral - US Treasury bonds. The yield on this debt is considered to be credit risk-free, and is therefore a pure representation of the baseline yield of the financial system based upon nominal yield + inflation expectations.

From this risk free rate, all other assets (think of them as lego blocks that keep stacking on top of the risk free rate) are priced as a combination of this rate + some version of a risk premium. From here, the riskier you go, the higher the risk premium. As you go from corporate bonds to equities, to private equity, to venture capital, all the way to crypto, this risk premium widens as investors demand an excess return above the risk free rate to compensate for the added risk.

Not only this, but the risk free rate is also used as the primary discount rate for the valuation of all assets. Into the input of all DCF’s that value equities lies this risk free rate at the bedrock of the valuation.

The financial complex assumes this risk free rate to be true, pure, unmanipulated, and sound. No one questions thy risk-free rate. But after 15 years of QE where the Fed was actively involved as a price insensitive buyer in the purchasing of US debt, one must ask themselves whether this has warped what the actual risk free rate should be.

George Robertson of The Monetary Frontier has been doing some interesting work as of late on the following idea: “what is the true risk free rate, unencumbered by central bank activity?”

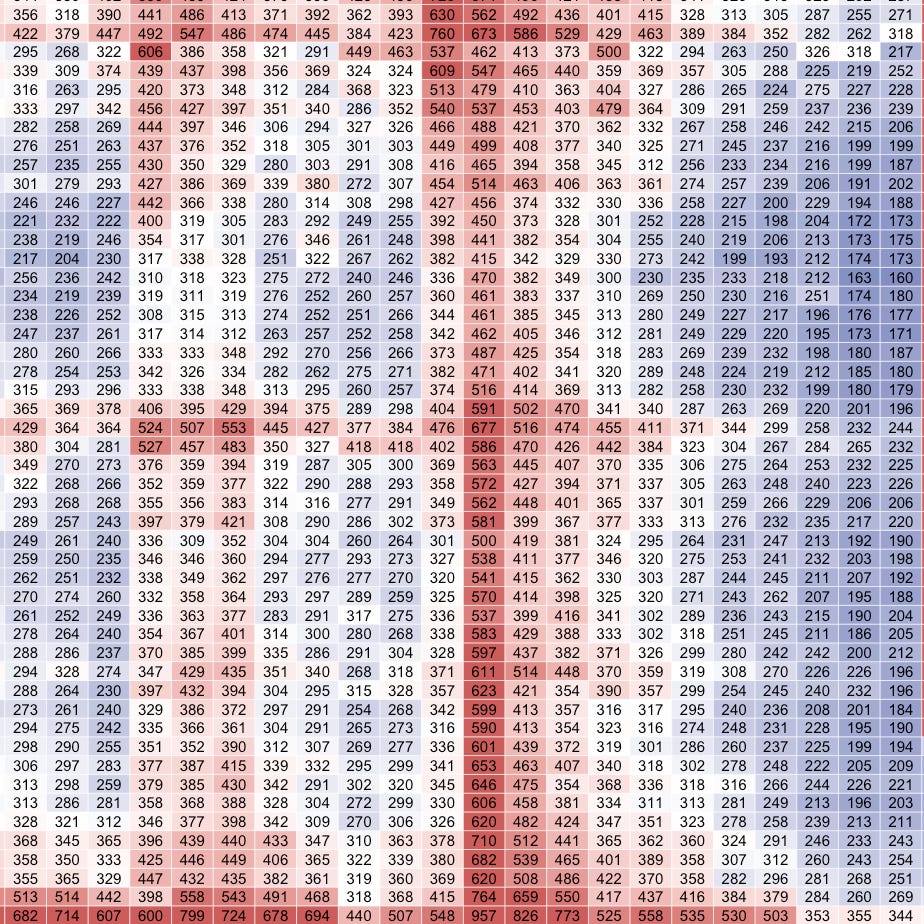

Through taking a 5 or 10 year rolling average of the historical spread between the 30 year mortgage rate and the 10 year Treasury yield and subtracting that from the 30 year then using that to compare the “official” Treasury 2-10y spread curve to his “clean” market implied curve, we see a major dislocation has occurred since 2020 when the Fed pursued “QE infinity”.

Source and all credit to:

Suddenly a lot of things that haven’t been making sense lately start to! The curve isn’t actually inverted and the recession that so many have been calling for but never seems to show up has no reason to show up because the economy is steaming ahead at full speed.

Further, the discount rate that the entire financial system uses to price all assets against is artificially suppressed!

If every asset in finance is priced off a risk-free rate that is no longer considered to be market derived and has too much noise associated with it, the “real price” of anything becomes difficult to value. From this emerges the need for a benchmark that is truly free of any form of financial interventionism that can accurately be used as a north star for all other financial assets to be valued from.

Suddenly the case for a financial asset with a decentralised, tamperproof, distributed ledger technology with a fixed monetary supply that has no monetary intervention baked into the price becomes very valuable as a true price signal for financial assets.

Enter Bitcoin. Sure, it’s volatile right now as it works through its teenage years and the growing pains associated with it. But big picture, Bitcoin could be argued to be the last true “free” market in the world and can serve as an accurate bellwether of liquidity conditions and the true price of money.

Alongside complex econometric models reside endless assumptions, one of which is that market participants make economic decisions based on demand and supply and the price of assets. I’ll tell you one thing: a central bank buying an unlimited amount of Treasuries at any price in the form of QE is not exactly an economic and rational market participant.

Back in 2006-2007, Bernanke argued the curve inversion represented distortion from huge Asian demand for USTs pushing down interest rates at the long end. Correcting for this, the curve was not actually inverted.